Our output spans from comprehensive company and thematic analysis to innovative quant, strategy and cross-sector reports.

Our Products

Providing our clients with high-quality financial analysis and thought-provoking insights both in written form and through audio and video media.

Specialist economic analysis ranging from daily reactive market updates, weekly bulletin notes and global macro markets reports.

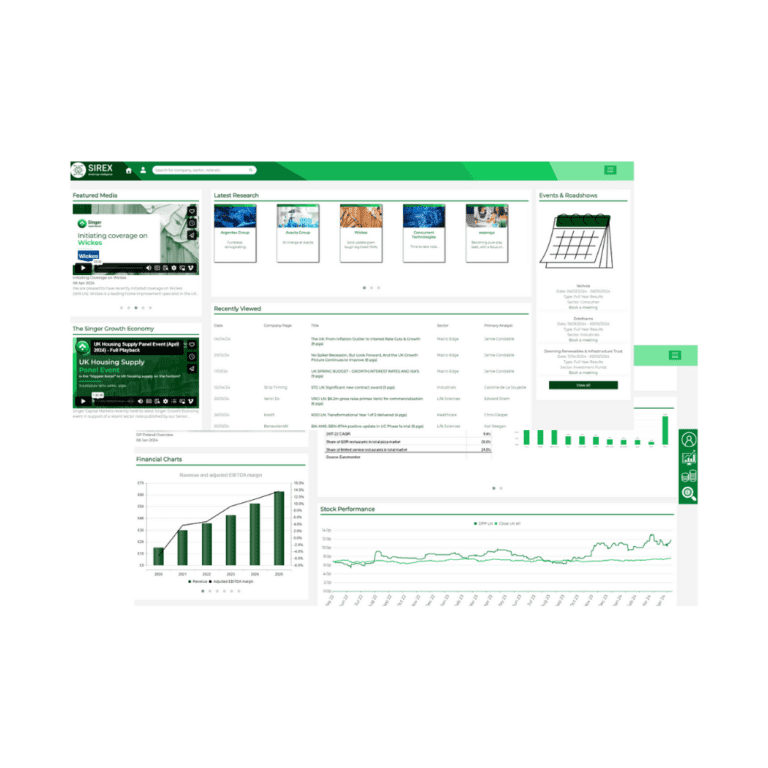

An evolutionary platform which provides investors with a more advanced way of engaging with our research, moving away from traditional ‘static’ research to a dynamic display of information and content; a key USP to our research product.

Bringing pivotal topics and key analysis to life in the form of webinars, conferences, lunch & evening events and panel discussions. To hear about our upcoming events please email events@singercm.com.

Introducing SIREX – A new, dynamic way to engage with research

Our Latest Reports