£20 million AIM IPO

Singer Capital Markets is pleased to have acted as Nominated Adviser & Sole Broker to Aurrigo plc (‘AURR’) on their £20 million AIM IPO.

Aurrigo plc, a leading international provider of technology solutions, today (15/09/2022) admitted its entire issued share capital, being 41,666,667 Ordinary Shares, at a Placing Price of 48 pence per share, to trading on the AIM market of the London Stock Exchange, raising £8 million on admission.

The Directors believe that Admission is an important step in Aurrigo’s continuing development and will accelerate its commercial progression. In particular, the Placing will provide the Company with the capital to execute the Board’s growth plans.

Proceeds of the Placing will be used to:

- realise the potential growth of the Company’s Aviation Division;

- scale headcount at all levels, both in the UK and internationally;

- increase brand awareness and enhance the Company’s profile; and

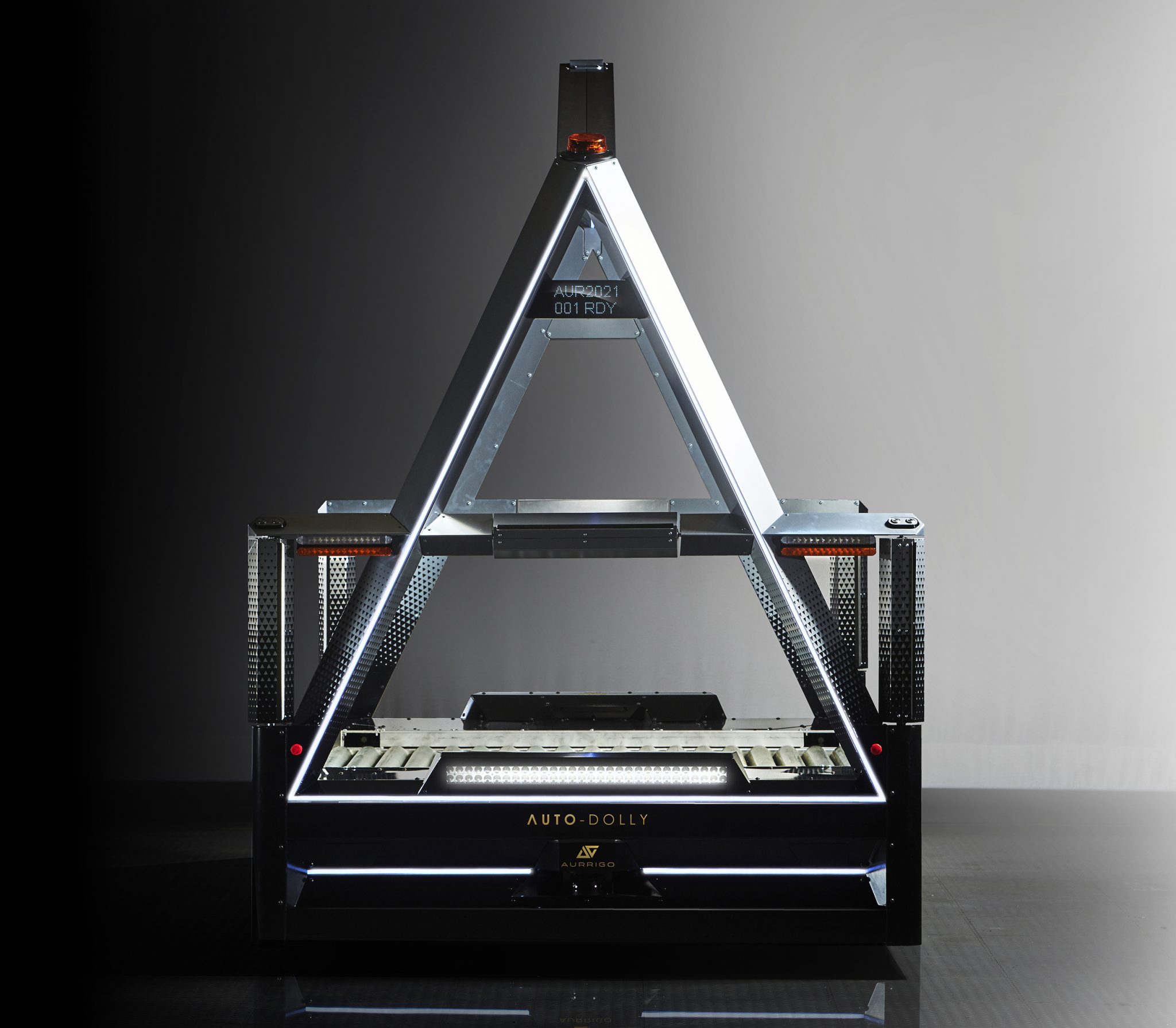

- capitalise on its early mover advantage, through the deployment of Auto-Sim and Auto-Dolly, the company’s lead products.

Prof. David Keene, Chief Executive Officer of Aurrigo, commented:

“Achieving our listing and fundraise in these challenging markets is a real testament to the great technology, sound business and talented team we have at Aurrigo. It gives us a solid platform for growth and we are excited about taking the next step on our journey.

We’re now in a great position to deliver on our planned projects and opportunities, particularly in the aviation space, introducing autonomous solutions which can improve efficiencies, staffing shortages and sustainability for airport operations globally.”

Singer Capital Markets has been retained as the Company’s Nominated Adviser and Broker post admission.

About Aurrigo plc

Aurrigo is a leading international provider of transport technology solutions. The company designs, engineers, manufactures and supplies OEM products and autonomous vehicles to the automotive and transport industries. It is highly regarded as a specialist in autonomous and semi-autonomous technology solutions for the aviation, ground handling and cargo industries. The company has three divisions: Automotive Technology, Autonomous Technology and Aviation Technology.

Website: Click here

Ticker: AURR

Market Cap: £20 million*

*As at 15/09/2022

Contact us

Call +44 (0)20 7496 3000

or email enquiries@singercm.com