The Trust and Corporate Services (“T&CS”) market is global and growing, with increased regulatory requirements driving demand and strengthening barriers to entry. Increasing levels of complexity of the services required lead to higher margins. We see high quality, resilient and recurring earnings, based on long-term client relationships. Predominantly fixed fee and time-based charging insulate fees from underlying asset price movements.

What do T&CS providers do?

Trust and Corporate Services focus on the set up, administration, servicing and winding up of legal structures such as trusts, funds and other special purpose vehicles. The market is broadly divided in three distinct segments, notably funds, private clients and corporates. Despite clear differences, T&CS providers often cover more than one of the segments, given the inherent cross-sell potential of services.

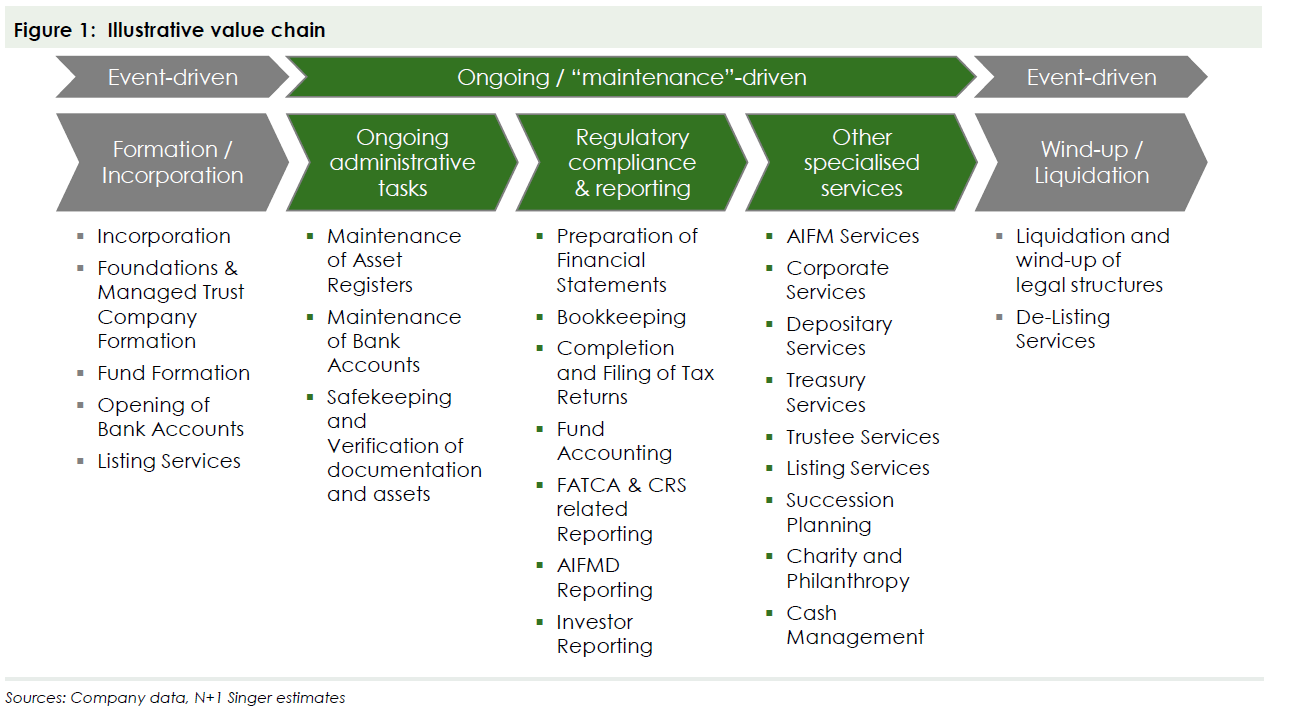

The majority of services provided are ongoing, “maintenance” driven in the form of administrative tasks, regulatory compliance and reporting, as well as other specialised services. Additionally T&CS providers offer more event-driven services such as the formation/incorporation, as well as the liquidation of legal structures.

- Institutional Clients – Specialised T&CS providers focus on the administration of alternative asset funds, particularly more illiquid, closed-end funds as the higher complexity warrants higher margins and, together with long lock-ups forms the most attractive part of the T&CS market.

- Private Clients – Albeit not including any lock-up features as found in alternative asset funds, HNWIs and family offices tend to set up trust and other asset structures for the long term.

- Corporates – The corporate segment of the market is perceived as the most volatile and least attractive. It often requires significantly more jurisdictional coverage as compared to funds and private clients and often comes with shorter expected structure lives.

- The majority of fee income is charged on a fixed or time-costed basis, with ad valorem charges remaining the exception. This provides insulation from changes in underlying asset prices.

- Long average structure lives, typically around 10 years, provide resilient and highly visible income streams for the service providers.

- Once appointed administrator to a fund or trust structure, it is unusual to lose a mandate during the structure life given the high risk of disruption (e.g. investor reporting).

Global – but not everywhere

The T&CS industry is global, with the key players in the market covering wide ranges of jurisdictions. Whilst regulatory changes and global politics strongly influence the playing field, we see certain key characteristics that attractive jurisdictions require.

- Ease of doing business

- Robust legal frameworks, sound judiciary environments together with political stability provide elementary traits expected from attractive locations to do business.

- Tax neutrality, low(er) tax burden and low threat of tax evasion

- Strong and developed financial services sectors

Onshore, offshore, midshore? Morally-driven public debates and global politics promoting protectionism have challenged the stereotype of the offshore jurisdiction, such as the BVIs and Cayman Islands. Whilst the key countries do provide full compliance and transparency with laws and regulations, we have seen moves to mid- and onshore jurisdictions to potentially avoid reputational risks that are, in some cases, falsely associated with a range of business environments.

Regulatory evolution driving demand

Regulatory changes introduced in the T&CS space have added to the complexity of the overall landscape and related services and increased the compliance burden for corporates, individuals and funds. Whilst increased regulation and oversight may have detrimental effects on some industries, the T&CS sector benefits from these changes as it increases the demand for specialist services in response to increased complexities.

Attractive economic model

T&CS providers have an operationally geared economic model, generating high quality and resilient shareholder returns. Attractive average structure lives of c. 10 years underpin visible and highly recurring income streams. Funds tend to be particularly reluctant to change their administrator during the life of a structure, due to the high disruption risk, which further underpins earnings resilience.

Strong growth in underlying markets

The market backdrop is positive, demand being fuelled by growing underlying markets as well as regulatory change and increasing complexity of transactions.

Recent transactions driven by industry consolidation

The T&CS sector has seen a high degree of transaction activity, including trade sales, sponsor deals and public market activity. Ongoing consolidation is manifested in sizeable specialists acquiring smaller, often sub-scale firms to branch out into new or strengthen existing service lines and/or add jurisdictions. Further scaling is supported by financial sponsor ownership, which has become very common throughout the industry, with the majority of sizeable players being private equity owned at this stage. We have seen some public markets activity with the listing of Sanne Group, Intertrust and most recently JTC.

To receive the full detailed Trust and Corporate Services Note, please contact Research Entitlement.